Regulations requiring cannabis shops in B.C. to have opaque windows serve as a potential safety issue for the storefronts.

That’s according to Andrew Gordon, Senior Vice President of Strategic Partnerships and Community at cannabis retailer Kiaro, who also serves as a director of the Association of Canadian Cannabis Retailers (ACCRES).

“It sounds like a simple thing but it has a huge impact,” Gordon told BotaniQ Magazine. “You look at destigmatizing the industry, you look at integrating and normalizing cannabis on the social scene, and you see these very drab and very opposing barriers to entry with consumers in this community and opaque window does not signify an open, legal welcoming environment all the time.”

He said some operators are “reinterpreting” the rules, instead creating living walls or coming up with other creative solutions.

“But it still limits the sight lines that we have to the community and the community to us and poses legitimate security concerns that security experts themselves, are are reciprocating,” he noted.

Gordon pointed to the potential of the public walking into an active robbery, or other turbulent scenarios.

“I’m not seeing what’s going on in the store from the outside from a general police and community view and that poses some significant challenges,” he said.

READ ALSO: Kiaro expands to B.C. with flagship Vancouver cannabis store

Some communities are actually pushing back on the window opacity issue.

“We saw licenses actually denied in the City of North Vancouver because they didn’t want three operators on their main drag having opaque windows even though that’s a provincial mandate,” Gordon explained. “There’s still a lot of work to do to evolve the understanding to build congruence between provincial and municipal regulations, and to make sure those are responsive to both consumer and community interest.”

Meantime, Gordon noted that supply issues persist for retailers, who are still challenged with “stocks out” on some pretty significant product categories including pre-rolls and CBD products.

“I understand this is new and unprecedented. There’s a lot of other things on their bandwidth, but we need to be mindful of really getting this right, particularly in B.C., if we have any hope of eroding the illicit market, converting the consumer base and driving revenue potential and creating sustainable business opportunities for small and midsize operators, which drive 98 per cent of the business in the province.”

In his role with ACCRES, Gordin said this issue is a “constant point of discussion” in conversations with politicians at both municipal and provincial levels.

So far, sales in B.C. have been far off the mark in terms of expectations.

Despite the province’s reputation for its renowned “B.C. bud,” recent data from Statistics Canada reveals that B.C. has sold just $19.5 million of recreational cannabis. Only the small province of PEI has sold less, with $10.7 million in sales across the country.

“With the particular provincial model we have here we are definitely challenged by interesting impacts we don’t see in other markets, such as Saskatchewan,” said Gordon. “The BC Liquor Distribution Branch controlling the flow and quality and variety of products available to retailers in the market, we have to continually build an ongoing conversation and understanding with the LDB around what products consumers want, when they want them, the variety, the quality components and then really making the ordering process, the delivery process more streamlined and in line with existing Industries like alcohol.

“They seem to have in some context either reinvented the wheel or not considered some of these advancements we’ve made in the other industries that they helped steward and regulate.”

ACCRES is reminding leaders of the issues and “staying collective in our actions,” he noted.

“If we’re going to have any hope of creating and realizing the utopia potential that cannabis has for our province in terms of economic impact and eroding the illicit market and protecting public health and safety, and keeping us out of the hands of young people, then we really need to work together to build a sight line on these key issues that are big stumbling blocks out the gate: The quality and variety the consistency of supply,” he stressed. “It’s great that phase two products are now coming in. You look at what the products online are really, you know blowing off the shelves. It is a lot of these extract products, these are what consumers need these what they expect to see when they walk into a retail environment and having those come into the legalized supply stream.”

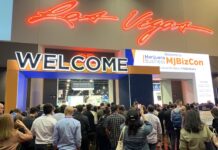

The introduction of edibles, concentrates and topicals is expected to be a recurring theme at the International Cannabis Business Conference in Vancouver on Sept. 15-16, as the new product categories are expected to attract three million new consumers to the market, and could be worth $2.7 billion annually.

Gordon is among those speaking at the International Cannabis Business Conference in Vancouver this weekend (Sept. 15-16). He will be speaking on a panel about Vancouver and British Columbia regulations alongside Dori Dempster, executive director of the Medicinal Cannabis Dispensary, and cannabis lawyer John Conroy, who is filing a lawsuit on behalf of medical users with respect to the low THC limits Health Canada has established for cannabis edibles and extract products. The panel will explore the great tradition of pioneering cannabis policies in Vancouver and B.C. and how regulations pose challenges for the legal market. “This panel will cover the latest regarding local cannabis policies and the hurdles and opportunities of navigating the landscape of a market with such a rich history of unregulated cannabis commerce,” organizers say.”